Completed dissertations

PhD Theses

2025 (0+), 2024 (1), 2023 (2), 2022 (1), 2018-2021 (0), 2017 (1), 2015-2016 (0), 2014 (1), 2013 (0), 2012 (1), 2011 (1)

-

Weronika Nitka (2024) Decision support for electricity market participants: point and probabilistic forecasting using resampling methods and statistical learning [PDF 9.1 MB]. Faculty of Management, PWr, Poland

PhD defense: 14.03.2025 (Pi Day 😉), degree awarded: 18.03.2025 with distinction 🏆

Auxiliary supervisor: Katarzyna Maciejowska

Reviewers: Florentina Paraschiv (Zeppelin University, Friedrichshafen, Germany 🇩🇪), Michał Rubaszek (Warsaw School of Economics, Poland 🇵🇱), Sławomir Śmiech (UE Kraków, Poland 🇵🇱)

Prizes and awards: Best Youngster Presentation award (International Conference on Computational Finance - ICCF, Wuppertal, Germany 🇩🇪, 2022), DIAMOND GRANT (MNiSW, Poland 🇵🇱, 2020; see Grants for details)

First job after PhD: Assistant Professor, Department of Operations Research and Business Intelligence, Wrocław University of Science and Technology, Poland

See also: IDEAS/RePEc profile, Scopus profile

-

Grzegorz Marcjasz (2023) Deep learning in point, probabilistic and ensemble forecasting of electricity prices [PDF 9.4 MB]. Faculty of Management, PWr, Poland

Slides: [PDF 3.6 MB] 🇬🇧

PhD defense: 30.01.2024, degree awarded: 27.02.2024 with distinction 🏆

Reviewers: Grzegorz Dudek (Częstochowa University of Technology, Poland 🇵🇱), Dogan Keles (Technical University of Denmark, Denmark 🇩🇰), Michał Rubaszek (Warsaw School of Economics, Poland 🇵🇱)

Prizes and awards: Outstanding paper in Energy Forecasting (International Institute of Forecasters, USA 🇺🇸, 2022), Jan Mozrzymas Scholarship of the Wrocław Academic Center (WCA, Poland 🇵🇱, 2020), Ministry scholarship for outstanding young scientists (MNiSW, Poland 🇵🇱, 2020), DIAMOND GRANT (MNiSW, Poland 🇵🇱, 2019; see Grants for details), Best student paper (runner-up) at the XV Conference on Computational Management Science (Trondheim, Norway 🇳🇴, 2018)

First job after PhD: Quant, Alpiq Energy SE, Poland 🇵🇱 / Switzerland 🇨🇭

See also: IDEAS/RePEc profile, Scopus profile

-

Bartosz Uniejewski (2023) Forecasting wholesale electricity prices to support decision-making in power companies: Use of regularization and forecast combinations [PDF 10.3 MB]. Faculty of Management, PWr, Poland

Slides: [PDF 4.2 MB] 🇬🇧

PhD defense: 13.06.2023, degree awarded: 20.06.2023 with distinction 🏆

Auxiliary supervisor: Katarzyna Maciejowska

Reviewers: Bogumił Kamiński (Warsaw School of Economics, Poland 🇵🇱), Sławomir Śmiech (UE Kraków, Poland 🇵🇱), James Taylor (Said Business School, University of Oxford, UK 🇬🇧)

Prizes and awards: Best Student Presentation at the International Symposium on Forecasting (ISF, Oxford, UK 🇬🇧, 2022), Outstanding paper in Energy Forecasting (International Institute of Forecasters, USA 🇺🇸, 2022), Jan Mozrzymas Scholarship of the Wrocław Academic Center (WCA, Poland 🇵🇱, 2021), Ministry scholarship for outstanding young scientists (MNiSW, Poland 🇵🇱, 2020), DIAMOND GRANT (MNiSW, Poland 🇵🇱, 2019; see Grants for details), laureate of the Best diploma of the year 2018/2019 among graduates of the second degree studies at PWR (Marshal's Office, Wrocław, Poland 🇵🇱, 2019), Winner of the BNY Mellon Master's Thesis Competition (BNY Mellon Science, Poland 🇵🇱, 2019)

First job after PhD: Assistant Professor, Department of Operations Research and Business Intelligence, Wrocław University of Science and Technology, Poland

See also: IDEAS/RePEc profile, Scopus profile

-

Tomasz Antczak (2022) Opracowanie agentowego modelu kolejkowego oraz ocena wpływu instalacji kas samoobsługowych na wydajność procesów kasowych w supermarketach (Development of an agent-based queuing model and evaluation of the impact of installing self-service checkouts on the efficiency of checkout processes in supermarkets). Faculty of Management, PWr, Poland

Slides: Polish version [PDF 2.3 MB] 🇵🇱

PhD defense: 22.11.2022, degree awarded: 29.11.2022

Auxiliary supervisor: Jacek Zabawa

Reviewers: Bogumił Kamiński (Warsaw School of Economics, Poland 🇵🇱), Agnieszka Kowalska-Styczeń (Politechnika Śląska, Poland 🇵🇱), Małgorzata Łatuszyńska (Uniwersytet Szczeciński, Poland 🇵🇱)

First job after PhD: Head of Projects in Sales Organisation, Kaufland Polska, Wrocław, Poland

-

Jakub Nowotarski (2017) Forecast averaging as a method to mitigate risks related to decision making in an energy company. Faculty of Computer Science and Management, PWr, Poland

Slides: English version [PDF 4.2 MB] 🇬🇧, Polish version [PDF 4.1 MB] 🇵🇱

PhD defense: 01.06.2017, degree awarded: 27.06.2017 with distinction 🏆

Auxiliary supervisor: Katarzyna Maciejowska

Reviewers: Derek Bunn (London Business School, UK 🇬🇧), Sławomir Śmiech (UE Kraków, Poland 🇵🇱)

Prizes and awards: Prime Minister's Prize for PhD Theses (Poland 🇵🇱, 2018), Ministry of Higher Education scholarship for PhD students (MNiSW, Poland 🇵🇱, 2016), Wincenty Styś Scholarship for outstanding achievements in Social Sciences and Humanities (Wrocław Municipality, Poland 🇵🇱, 2015), 2nd place in the Price Track of the Global Energy Finance Competition GEFCom2014 (USA 🇺🇸, 2015; jointly with Katarzyna Maciejowska), International Symposium on Forecasting 2015 travel grant award (International Institute of Forecasters, USA 🇺🇸, 2015), Best Ph.D. student paper and presentation at the Conference on Energy Finance (Erice, Italy 🇮🇹, 2014), PRELUDIUM research grant (NCN, Poland 🇵🇱, 2014; see Grants for details)

First job after PhD: Quant, Model Risk Management Group, BNY Mellon, Wrocław, Poland

See also: IDEAS/RePEc profile, Scopus profile

-

Artur Sierociuk (2014) System zarządzania ryzykiem w uczelni publicznej (Risk management system at a public higher education institution). Faculty of Computer Science and Management, PWr, Poland

PhD defense: 08.07.2014, degree awarded: 30.09.2014

Reviewers: Katarzyna Kuziak (UE Wrocław, Poland 🇵🇱), Mateusz Pipień (UE Kraków, Poland 🇵🇱)

First job after PhD: Internal Auditor, PWr, Poland -

Adam Misiorek (2012) Krótkoterminowe prognozowanie i zarządzanie ryzykiem w przedsiębiorstwie elektroenergetycznym z wykorzystaniem modeli niegaussowskich (Short-term forecasting and risk management in an energy company with non-Gaussian models). Faculty of Computer Science and Management, PWr, Poland

PhD defense: 08.01.2013, degree awarded: 29.01.2013

Reviewers: Małgorzata Doman (UE Poznań, Poland 🇵🇱), Jacek Mercik (PWr, Poland 🇵🇱)

First job after PhD: Risk Manager, Santander Consumer Bank, Wrocław, Poland

See also: IDEAS/RePEc profile -

Joanna Janczura (2011) Stochastic modeling of prices in the energy market. Institute of Mathematics and Computer Science, PWr, Poland

PhD defense: 03.04.2012, degree awarded: 08.05.2012

Reviewers: Jacek Jakubowski (Uniwersytet Warszawski, Poland 🇵🇱), Łukasz Stettner (IM PAN, Warszawa, Poland 🇵🇱)

Prizes and awards: Scholarship Przedsiębiorczy Doktorant - Entrepreneurial PhD Student (Lower Silesian Voivodship, Poland 🇵🇱, 2010), Scholarship GRANT for PhD students (Lower Silesian Voivodship, Poland 🇵🇱, 2009)

First job after PhD: Assistant Professor, Institute of Mathematics and Computer Science, PWr, Wrocław, Poland

See also: IDEAS/RePEc profile, Scopus profile

MSc Theses

2025 (2+), 2024 (1), 2023 (4), 2021-2022 (0), 2020 (3), 2019 (2), 2017-2018 (0), 2016 (1), 2015 (1), 2014 (0), 2013 (4), 2012 (1), 2011 (3), 2010 (4), 2009 (4), 2008 (2), 2007 (2), 2006 (3), 2005 (4), 2004 (3), 2003 (3), 2002 (1), 2001 (0), 2000 (4), 1999 (2)

-

Alicja Jaworska (2025, BI) Managing a battery storage system in the day-ahead market: Predicting prices for individual hours vs. predicting price differences

First appointment after MSc: IT Project Coordinator, Deviniti, Poland 🇵🇱 -

Piotr Zaborowski (2025, BI) Managing a battery storage system in the day-ahead market: A comparison of averaging forecasts over calibration windows and identifying breakpoints for estimating regression models

Prizes and awards: 2nd place in the 3-minute student talks competition (BI Day, Poland 🇵🇱, 2025)

Appointments after MSc: PhD Student, PWr, Poland 🇵🇱 (expected graduation: 2029) -

Erwin Marysiok (2024, BI) Ensemble forecasting of electricity prices for decision support

First appointment after MSc: .NET Developer, Monitor ERP System Polska, Poland 🇵🇱 -

Katarzyna Chęć (2023, BI) Short-term forecasting of the seasonal component: Decision support in day-ahead electricity trading

Prizes and awards: 1st place in the 3-minute student talks competition (BI Day, Poland 🇵🇱, 2023)

Appointments after MSc: PhD Student, PWr, Poland 🇵🇱 (expected graduation: 2027); Data Scientist, HEADFOUND GmbH, Poland 🇵🇱 / Germany 🇩🇪

Related publication(s): K. Chęć, B. Uniejewski, R. Weron (2025) Extrapolating the long-term seasonal component of electricity prices for forecasting in the day-ahead market, Journal of Commodity Markets 37, 100449 (doi: 10.1016/j.jcomm.2024.100449). Working paper version available from RePEc: https://ideas.repec.org/p/ahh/wpaper/worms2404.html -

Karolina Dymek (2023, BI) Forecasting electricity prices by identifying breakpoints using Python and SAP: Selecting the best computing environment for business applications

First appointment after MSc: Junior Applications Consultant, Capgemini, Poland 🇵🇱 -

Wioletta Szykuła (2023, AM) Forecasting electricity generation from wind farms

First appointment after MSc: Kierownik zespołu analityków, RENPRO, Poland 🇵🇱 -

Hammad Ullah (2023, BI) Ensemble forecasting of electricity prices for managing a power portfolio

First appointment after MSc: Full Stack Developer, HEADFOUND GmbH, Poland 🇵🇱 / Germany 🇩🇪 -

Alicja Kaszuba (2020, AM) Using local autoregressive (LAR) models for forecasting day-ahead electricity prices

-

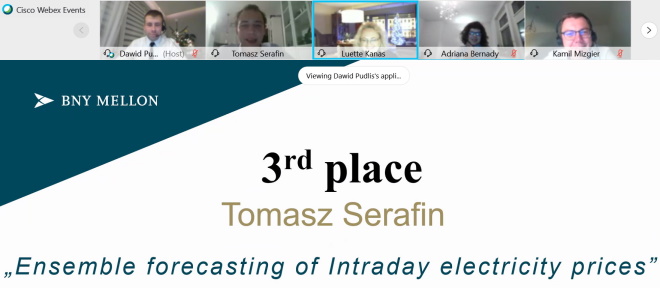

Tomasz Serafin (2020, AM) Ensemble forecasting of intraday electricity prices

Prizes and awards: DIAMOND GRANT (MNiSW, Poland 🇵🇱, 2020; see Grants for details), 3rd place in the BNY Mellon Master's Thesis Competition (BNY Mellon Science, Poland 🇵🇱, 2020)

First appointment after MSc: PhD Student, PWr, Poland 🇵🇱 (expected graduation: 2024)

See also: IDEAS/RePEc profile, Scopus profile

-

Adam Spychała (2020, ZARZ) Modeling and forecasting of electricity prices and demand

-

Grzegorz Marcjasz (2019, AM) Forecasting electricity prices: A comparison of deep and shallow neural networks

Prizes and awards: DIAMOND GRANT (MNiSW, Poland 🇵🇱, 2019; see Grants for details), Best Student Paper prize (runner-up) at the Computational Management Science CMS2018 conference (Trondheim, Norway 🇳🇴, 2018)

First appointment after MSc: PhD Student, PWr, Poland 🇵🇱 (see PhD students)

See also: IDEAS/RePEc profile, Scopus profile

-

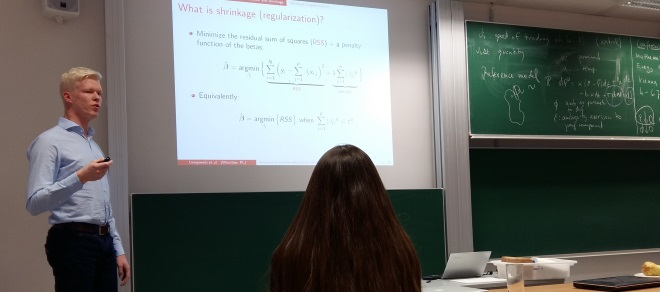

Bartosz Uniejewski (2019, AM) Probabilistic forecasting based on quantile regression and regularization

Prizes and awards: DIAMOND GRANT (MNiSW, Poland 🇵🇱, 2019; see Grants for details), laureate of the Best diploma of the year 2018/2019 among graduates of the second degree studies at PWR (Marshal's Office, Wrocław, Poland 🇵🇱, 2019), Winner of the BNY Mellon Master's Thesis Competition (BNY Mellon Science, Poland 🇵🇱, 2019)

First appointment after MSc: PhD Student, PWr, Poland 🇵🇱 (see PhD students)

See also: IDEAS/RePEc profile, Scopus profile

-

Michał Kucharczyk (2016, MFU) Krótkoterminowe prognozowanie cen energii elektrycznej z wykorzystaniem uśredniania prognoz modeli siostrzanych

First job after MSc: Business Intelligence and Credit Risk Management Specialist, Bank Zachodni WBK S.A., Wrocław, Poland 🇵🇱 -

Michał Olejnik (2015, MFU) Modelowanie i prognozowanie ściągalności wierzytelności

-

Iwona Klinowska (2013, ECMI) Forecasting spikes in Australian electricity spot prices

First job after MSc: Technical Analyst, Credit Suisse, Wrocław, Poland 🇵🇱 -

Paweł Maryniak (2013, ECMI) Using indicated demand and generation data to predict price spikes in the UK power market

Prizes and awards: DIAMOND GRANT (MNiSW, Poland, 2012; see Grants for details) 🇵🇱

First appointment after MSc: Expert, Ministry of Development, Poland 🇵🇱

Related publication(s): P. Maryniak, R. Weron (2019) What is the probability of an electricity price spike? Evidence from the UK power market, in "Handbook of Energy Finance: Theories, Practices and Simulations", eds. S. Goutte, D.K. Nguyen, World Scientific. Earlier working paper version available from RePEc: https://ideas.repec.org/p/wuu/wpaper/hsc1411.html -

Jakub Nowotarski (2013, MFU) Krótkoterminowe prognozowanie spotowych cen energii elektrycznej z wykorzystaniem uśredniania modeli

See: PhD Students -

Michał Zator (2013, ECMI) Relationship between spot and futures prices in electricity markets. Pitfalls of regression analysis

Appointments after MSc: PKP Intercity, Poland 🇵🇱; Research Assistant, Center for Law & Economics, ETH Zurich, Switzerland 🇨🇭; PhD Student, Kellogg School of Management, Evanston, IL, USA 🇺🇸; Department of Finance, Mendoza College of Business, University of Notre Dame, USA 🇺🇸

Related publication(s): R. Weron, M. Zator (2014) Revisiting the relationship between spot and futures prices in the Nord Pool electricity market, Energy Economics 44, 178-190 (doi:10.1016/j.eneco.2014.03.007). Working paper version available from RePEc: http://ideas.repec.org/p/wuu/wpaper/hsc1308.html

See also: IDEAS/RePEc profile -

Monika Szydło (2012, MFU) Wygładzanie wykładnicze w prognozowaniu procesów rynkowych

-

Adam Bukowski (2011, MFU) Szeregi czasowe z szumem niegaussowskim: kalibracja i prognozowanie

First job after MSc: Specialist, Bank Zachodni WBK S.A., Wrocław, Poland 🇵🇱 -

Agnieszka Janek (2011, MFU) The vanna-volga method for derivatives pricing

First job after MSc: Analyst, Ernst & Young, Cologne, Germany 🇩🇪

Related publication(s): A. Janek, T. Kluge, R. Weron, U. Wystup (2011) FX smile in the Heston model, in "Statistical Tools for Finance and Insurance (2nd ed)", eds. P. Cizek, W. Haerdle, R. Weron, Springer-Verlag, Berlin, 133-162. Preprint version Available from MPRA: http://mpra.ub.uni-muenchen.de/25491/, arXiv.org: http://arxiv.org/abs/1010.1617

See also: IDEAS/RePEc profile -

Daniel Kucharczyk (2011, ECMI) The Heston model for pricing path dependent options

First appointment after MSc: PhD Student, PWr, Poland 🇵🇱 (graduated: 2018) -

Piotr Majer (2010, MFU) Pricing structured currency products

First appointment after MSc: PhD Student, Humboldt University Berlin, Germany 🇩🇪 (graduated: 2015) -

Jarosław Mrugała (2010, ECMI) Foreign exchange market - modeling and forecasting exchange rates

-

Mateusz Wiewiórko (2010, MFU) Zarządzanie ryzykiem w przedsiębiorstwie. Miary ryzyka EaR, CFaR i PaR

First job after MSc: Junior Analyst, Getin Noble Bank S.A., Wrocław, Poland 🇵🇱 -

Paweł Wróbel (2010, MFU) Opcje realne w wycenie projektów inwestycyjnych

-

Janusz Gajda (2009, MFU) Opcje koszykowe a lokaty strukturyzowane - wycena

First appointment after MSc: PhD Student, PWr, Poland 🇵🇱 (graduated: 2014)

See also: IDEAS/RePEc profile -

Joanna Janczura (2009, ECMI) Subdynamics of financial data from fractional Fokker-Planck equation

First appointment after MSc: PhD Student, PWr, Poland 🇵🇱

See: PhD Students -

Piotr Małecki (2009, MFU) Symulacyjne metody wyceny opcji amerykańskich

-

Katarzyna Smaga (2009, MFU) Metody oceny ryzyka operacyjnego

First job after MSc: Consultant, Nagler & Company, Germany 🇩🇪 -

Andrzej Motyka (2008) Sztuczna inteligencja kontra modele statystyczne: Czy sieci neuronowe portrafią lepiej prognozować ceny energii?

-

Maja Włoszczowska (2008) Wojny Coli (Cola wars) - czyli siła reklamy na rynku oligopolicznym

Related publication(s): K. Sznajd-Weron, R. Weron, M. Włoszczowska (2008) Outflow Dynamics in Modeling Oligopoly Markets: The Case of the Mobile Telecommunications Market in Poland, Journal of Statistical Mechanics P11018 (doi: 10.1088/1742-5468/2008/11/P11018). Available from MPRA: http://mpra.ub.uni-muenchen.de/10422/

See also: Silver medalist - Beijing 🇨🇳 (2008) and Rio de Janeio 🇧🇷 (2016) Olympics!!! More on olimpijski.pl

-

Michał Baryliński (2007) Modelowanie i prognozowanie cen i zapotrzebowania na energię elektryczną z wykorzystaniem sieci neuronowych

First job after MSc: Credit Risk Management Specialist, Bank Zachodni WBK S.A., Wrocław, Poland 🇵🇱 -

Łukasz Małek (2007) Finanse behawioralne; badanie skłonności poznawczych inwestorów

-

Joanna Kątnik (2006) Algorytmy genetyczne i inne techniki sztucznej inteligencji w modelowaniu cen energii

-

Jakub Jurdziak (2006) Modele zmieniające stany (regime-switching): symulacja, estymacja parametrów i zastosowania

-

Przemysław Puchalski (2006) Modelowanie sezonowości w danych finansowych za pomocą szeregów SARIMA i PARMA

-

Grzegorz Boczar (2005) Rozkłady hiperboliczne w modelowaniu finansowym

-

Przemysław Kaczmarek (2005) Porównanie modeli struktury terminowej stóp procentowych

-

Adam Ocharski (2005) Analiza składowych głównych w modelowaniu implikowanej zmienności

-

Paweł Omelko (2005) Rozkłady gruboogonowe - implementacja w Javie

-

Katarzyna Samuła (2004) Modelowanie ryzyka kredytowego dla banku Pekao S.A. - oddział w Wałbrzychu

-

Piotr Uniejewski (2004) Koherentne miary ryzyka

First job after MSc: Data Analyst, Kruk S.A., Wrocław, Poland 🇵🇱 -

Szymon Wysoczański (2004) Porównanie numerycznych metod wyceny opcji

-

Szymon Borak (2003) Implementacja bibliotek finansowych dla systemu XploRe

First appointment after MSc: PhD Student, Humboldt University Berlin, Germany 🇩🇪 (graduated: 2008)

Related publication(s): Sz. Borak, W. Haerdle, R. Weron (2005) Stable distributions, in "Statistical Tools for Finance and Insurance", eds. P. Cizek, W. Haerdle, R. Weron, Springer-Verlag, Berlin, 21-44

See also: IDEAS/RePEc profile -

Andrzej Szymański (2003) Prognozowanie cen i zapotrzebowania na energię elektryczną za pomocą szeregów czasowych i sieci neuronowych

-

Sławomir Wójcik (2003) Generator scenariuszy dla portfeli opcyjnych - toolbox w Matlabie

First job after MSc: Business Solution Architect, Comarch, Kraków, Poland 🇵🇱 -

Piotr Wilman (2002) Modelowanie cen i zapotrzebowania na energię elektryczną

Related publication(s): R. Weron, I. Simonsen, P. Wilman (2004) Modeling highly volatile and seasonal markets: evidence from the Nord Pool electricity market, in "The Application of Econophysics", ed. H. Takayasu, Springer, Tokyo, 182-191 -

Marek Kozłowski (2000) Moduł Zarządzania Ryzykiem w Symulatorze Rynku Instrumentów Pochodnych

First job after MSc: Researcher, IASE, Wrocław, Poland 🇵🇱 -

Adam Misiorek (2000) Alternatywne modele wyceny opcji a uśmiech zmienności

See: PhD Students -

Tomasz Piesiewicz (2000) Sieciowy symulator rynku instrumentów pochodnych w Polsce

First job after MSc: Researcher, IASE, Wrocław, Poland 🇵🇱 -

Paweł Talar (2000) Porównanie metod szacowania ryzyka rynkowego i kredytowego

First job after MSc: Specialist, Banking Supervision Department, National Bank of Poland (NBP) 🇵🇱 -

Tomasz Garliński (1999) Kontrakt VOLAX - próbą opisu zmienności cen instrumentów finansowych

-

Andrzej Zacharewicz (1999) Analiza zależności długoterminowej KGHM Polska Miedź S.A. Prizes and awards: 2nd place in the Warsaw University and Bank PEKAO S.A. competition for the best MSc Thesis in Financial Mathematics 🇵🇱

BSc and Engineering Theses

2025 (0+), 2024 (1), 2023 (0), 2022 (1), 2019-2021 (0), 2018 (3), 2017 (2), 2016 (9), 2015 (2), 2014-2009 (0), 2008 (6), 2007 (5), 2006 (1), 2005 (0), 2004 (1), 2003 (2), 2002 (6), 2001 (6)

-

Łukasz Serafin (2024, MS) Wpływ funkcji kary w modelach autoregresyjnych na wynik finansowy strategii handlowych na rynku energii elektrycznej

-

Julia Nasiadka (2022, MS) Wybór okna kalibracji na podstawie detekcji punktów zmiany na potrzeby prognozowania cen energii elektrycznej na rynku dnia następnego

Related publication(s): J. Nasiadka, W. Nitka, R. Weron (2022) Calibration window selection based on change-point detection for forecasting electricity prices. In: D. Groen et al. (eds.), Computational Science ICCS 2022, Lecture Notes in Computer Science 13352, Springer, https://doi.org/10.1007/978-3-031-08757-8_24 . Working paper version available from arXiv: https://doi.org/10.48550/arXiv.2204.00872 -

Agnieszka Boryczka (2018, INS) Krótkoterminowe prognozowanie zapotrzebowania na energię elektryczną - porównanie wygładzania wykładniczego i szeregów czasowych

-

Rafał Jakuczek (2018, INS) Prognozowanie cen energii elektrycznej na rynku dnia następnego - porównanie wygładzania wykładniczego i szeregów czasowych

-

Bartosz Uniejewski (2018, MS) Efektywne prognozowanie spotowych cen energii elektrycznej z wykorzystaniem modeli eksperckich i LASSO

Prizes and awards: Triple laureate of the Ministry of Higher Education scholarship for undergraduate students (MNiSW, Poland, 2016, 2017, 2018) 🇵🇱

Related publication(s): B. Uniejewski, R. Weron (2018) Efficient forecasting of electricity spot prices with expert and LASSO models, Energies 11(8), 2039 (doi: 10.3390/en11082039); B. Uniejewski, J. Nowotarski, R. Weron (2016) Automated variable selection and shrinkage for day-ahead electricity price forecasting, Energies 9(8), 621

(doi: 10.3390/en11082039); B. Uniejewski, J. Nowotarski, R. Weron (2016) Automated variable selection and shrinkage for day-ahead electricity price forecasting, Energies 9(8), 621  (doi: 10.3390/en9080621)

(doi: 10.3390/en9080621)

-

Yelim Han (2017, OM) Cultural differences in investor decisions based on price trends: Korea vs. Poland

-

Natalia Przybyłkiewicz (2017, OM) Gender differences in investor decisions based on price trends

-

Mateusz Kowalski (2016, MS) Modelowanie i prognozowanie cen aktywów finansowych z wykorzystaniem modeli z długą pamięcią

-

Joanna Krawczyk (2016, MS) Krótkoterminowe prognozowanie cen i zapotrzebowania na energię elektryczną - porównanie sieci neuronowych i szeregów czasowych

-

Jędrzej Łapacz (2016, Z) Czy dyrektorzy finansowi działają racjonalne? Ocena ich zachowań i decyzji handlowych na rynku finansowym

-

Jakub Maciejewski (2016, INS) Krótkoterminowe prognozowanie zapotrzebowania na energię elektryczną z wykorzystaniem szeregów czasowych

-

Felix Santa (2016, OM) Cola wars and agent-based models in marketing

-

Konrad Stachera (2016, INS) Krótkoterminowe prognozowanie zapotrzebowania na energię elektryczną z wykorzystaniem uśredniania prognoz

-

Tomasz Stanisławski (2016, MS) Wycena opcji egzotycznych na rynku walutowym

-

Agnieszka Szamocka (2016, MS) Krótkoterminowe prognozowanie cen energii elektrycznej z wykorzystaniem wygładzania wykładniczego

-

Agnieszka Turkiewicz (2016, OM) Integration of the financial and insurance worlds - examples of products offered in the Polish market

-

Karolina Gibes (2015, OM) Are investors rational? Assessment of their behavior and trading decisions in the financial market

-

Laurentiu Nita (2015, OM) Managing a currency portfolio of an enterprise: The risks of employing technical analysis

-

Paweł Billewicz (2008) Baza danych i portal materiałów dydaktycznych dla pracowników i studentów WPPT

-

Piotr Figiel (2008) Chaos deterministyczny - wizualizacje struktur złożonych

-

Bartosz Grzyb (2008) Czy inwestorzy są racjonalni? Badanie skłonności poznawczych inwestorów

-

Karolina Kopacz (2008) Co łączy żuka Mandelbrota z diagramem bifurkacyjnym?

-

Paweł Kowol (2008) Jaka jest długość wybrzeża Bałtyku? Pomiar struktur fraktalnych

-

Karolina Kulińska (2008) Jak skreslać żeby wygrać? Badanie zachowań i strategii graczy w toto-lotka

-

Maciej Bartodziej (2007) Modelowanie ruchu ulicznego za pomocą automatów komórkowych

-

Aldona Bodasińska (2007) Symulowanie nastrojów społecznych w Polsce za pomocą modeli sieciowych

-

Anna Rutkowska (2007) Modelowanie biologicznych układów typu drapiezca - ofiara z wykorzystaniem błądzenia losowego

-

Marcin Treffler (2007) Zaglądnij w głąb żuka Mandelbrota, czyli samopodobieństwo i fraktale

-

Roksana Wdowiak (2007) Identyfikacja struktur sieci złożonych

-

Marcin Szkudlarz (2006) Analiza ryzyka w przedsiębiorstwie: Implementacja metody CorporateMetrics

-

Renata Wywrot (2004) Modelowanie rozprzestrzeniania się epidemii SARS

-

Katarzyna Morawska (2003) Rozkłady alfa-stabilne w modelowaniu finansowym

-

Joanna Szot (2003) Rozkłady hiperboliczne w modelowaniu finansowym

-

Barbara Boroń (2002) Analiza i modelowanie kursów walutowych

-

Marta Chojecka (2002) Analiza i modelowanie cen akcji z GPWW

-

Przemysław Cichoń (2002) Rynek terminowy a spotowy: analiza i modelowanie stochastyczne

-

Katarzyna Dura (2002) Kalkulator stóp procentowych

-

Monika Różycka (2002) Modelowanie cen i zapotrzebowania na energię elektryczną

-

Marcin Szymański (2002) Wycena opcji metodą Monte Carlo

-

Nicos Karagieorgopulus (2001) Wartość narażona na ryzyko (VaR) dla polskiego rynku akcji - podejście klasyczne

-

Dariusz Kwiatek (2001) Wartość narażona na ryzyko (VaR) dla polskiego rynku akcji - symulacje Monte Carlo

-

Jarosław Małek (2001) Modelowanie danych finansowych za pomocą szeregów typu xARCH

-

Bartosz Rejent (2001) Analiza praw skalowania i zależności długoterminowych dla kursów walutowych

-

Karina Załucka (2001) Modelowanie danych finansowych za pomocą procesów dyfuzji

-

Joanna Zgórecka (2001) Analiza praw skalowania i zależności długoterminowych dla cen energii